February 8, 2023 – Uber Technologies, Inc. (NYSE: UBER) today announced financial results for the quarter and full year ended December 31, 2022.

Financial Highlights for Fourth Quarter 2022

Gross Bookings grew 19% year-over-year (“YoY”) to $30.7 billion, or 26% on a constant currency basis, with Mobility Gross Bookings of $14.9 billion (+31% YoY or +37% YoY constant currency) and Delivery Gross Bookings of $14.3 billion (+6% YoY or +14% YoY constant currency). Trips during the quarter grew 19% YoY to 2.1 billion, an all-time quarterly high, or approximately 23 million trips per day on average.

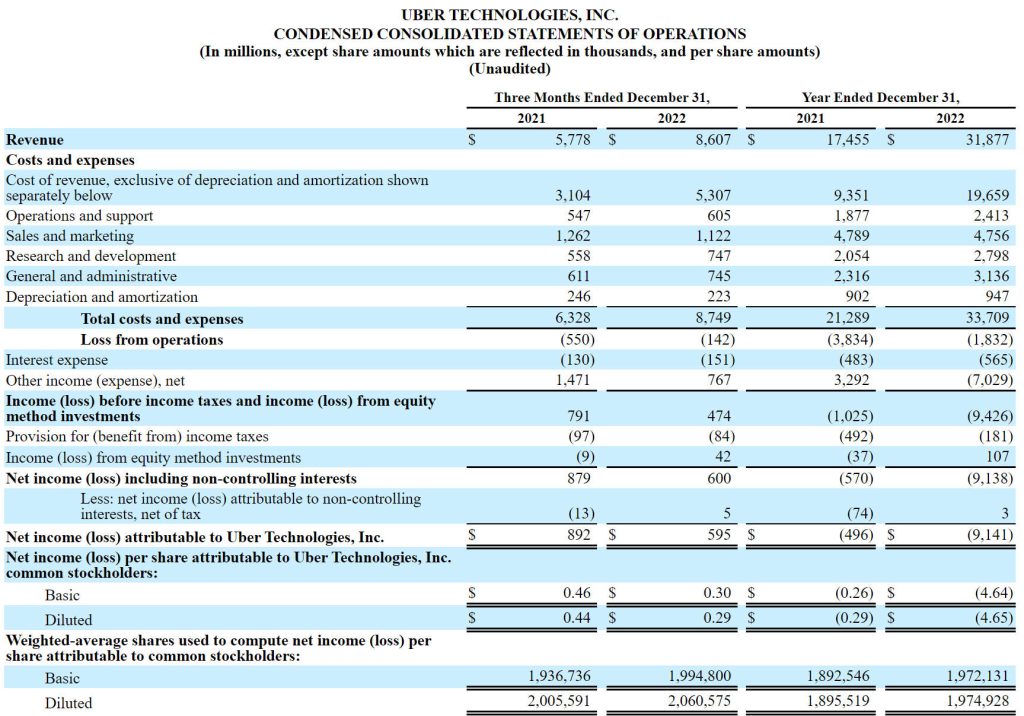

Revenue grew 49% YoY to $8.6 billion, or 59% on a constant currency basis, with Revenue growth significantly outpacing Gross Bookings growth due to a change in the business model for our UK Mobility business and the acquisition of Transplace by Uber Freight.

Uber posted Q4 earnings Wednesday of $0.29 per diluted share, down from $0.44 per share a year earlier. Analysts polled by Capital IQ expected a loss of $0.16 per share. Revenue was $8.61 billion, up from $5.78 billion a year ago. Analysts expected $8.51 billion.

Net income attributable to Uber Technologies, Inc. was $595 million, which includes a $756 million net benefit (pre-tax) primarily due to net unrealized gains related to the revaluation of Uber’s equity investments.

Adjusted EBITDA of $665 million, up $579 million YoY. Adjusted EBITDA margin as a percentage of Gross Bookings was 2.2%, up from 0.3% in Q4 2021. Incremental margin as a percentage of Gross Bookings was 11.9% YoY.

Net cash used in operating activities was $244 million and free cash flow, defined as net cash flows from operating activities less capital expenditures, was $(303) million. Through 2022, net cash provided by operating activities was $642 million, and free cash flow was $390 million. Net cash from operating activities and free cash flow during Q4 2022 and full year 2022 were impacted by a cash outflow of approximately $733 million (GBP 613 million), related to the previously disclosed HMRC VAT claims settlement in the UK. Excluding this settlement, free cash flow would have been $430 million and $1.1 billion in Q4 2022 and full year 2022, respectively.

Unrestricted cash, cash equivalents, and short-term investments were $4.3 billion at the end of the fourth quarter.

Outlook for Q1 2023

Gross Bookings to grow 20% to 24% YoY on a constant currency basis, with an expected 3 percentage point currency headwind, translating to a range of $31.0 billion to $32.0 billion.

Adjusted EBITDA of $660 million to $700 million.

Monthly Active Platform Consumers (“MAPCs”) reached 131 million: MAPCs grew 11% YoY and 6% QoQ to 131 million, driven by continued improvement in consumer activity for our Mobility offerings. Mobility MAPCs reached an all-time high of over 100 million.

Launched our single cross-platform membership program, Uber One, in Chile, France, Japan, Spain and Taiwan. Uber One is now available across 12 countries. In addition, announced a new offer for Capital One cardholders to get up to 24 months of free Uber One plus 10x cash back benefits. Our global member base nearly doubled YoY to nearly 12.

UBER TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

About Uber (NYSE:UBER)

Uber’s mission is to create opportunity through movement. We started in 2010 to solve a simple problem: how do you get access to a ride at the touch of a button? More than 37 billion trips later, we’re building products to get people closer to where they want to be. By changing how people, food, and things move through cities, Uber is a platform that opens up the world to new possibilities.