Microsoft Corp. (NASDAQ:MSFT) stock trading strategy: 2022.12.23 From the stock chart analysis, the probability of the recent stock price continuing to maintain a range of $230-$260 is extremely high, short-term can be buy above $230, the target price of $250-$255. The midline buys $230 with a target price of $260. The recommended stop price is $230, and the stock price stops falling and recovers and closes above $230 to cover the position. If it falls below $230, the probability of the stock price testing $215 downwards rises sharply. The stock price as a whole maintains a large range of fluctuations, and long-term profit space is limited. Recommended positions up to 10%. From a fundamental point of view, Q4 2022 achieved operating income of US$51.865 billion, YoY+12.38%, net profit attributable to common shareholders of US$16.74 billion, YoY +1.71%, and EPS US$2.23. Quarterly dividend of $0.67 per share. Announced an increase in quarterly dividend to $0.67. Sales growth slowed down in Q4, but growth remained double-digit and the value of long-term investment remained unchanged. TTM is 26.14 times (measured by the stock price of $252.220), and the current valuation is still relatively high, but compared with the software industry, the advantages are obvious.

Historical Forecast Record:

2022.9.20 From the technical chart, the recent stock price continues to fall, today’s stock price fell below the previous stage low, following the main index to fall together, temporarily do not see upside, the stock price may continue to bottom, it is recommended to focus on the next support level of $230, if it stabilizes, you can moderately take the anti-Bo space. The stock price fluctuation range was moved down to the range of $230-$260, and the stock price has fallen below the preset stop loss of 240 yuan, and short-term and medium-term recommendations are temporarily avoided. For the time being, there is no upside at the long-term level. Recommended position 10%.

2022.9.14 From the technical chart, the recent stock price continued to fall, once again came to the stage bottom area, the stock price as a whole maintained a range of $240-$290, there are short-term and medium-term opportunities, short-term and medium-term buying points backed by $250, stop loss $240, mid-term target price of $290, short-term target price of $270, or high selling and low suction. For the time being, there is no upside at the long-term level. Recommended position 10%.

2021.11.02 From the technical chart, the stock price is in an uptrend, it is recommended to hold long positions above the 20-day moving average for short-term trading, and long positions above the 60-day moving average for medium and long-term trading, the possibility of further strengthening is extremely high, and if it breaks through 330 yuan, it may challenge a new historical high. In the order of exits, short-term trading stock prices fell below the 20-day moving average and turned short, and medium and long-term trading fell below the 60-day moving average to turn short. From a fundamental point of view, the company’s new generation operating system Windows 11 is worth looking forward to, in addition, the company’s business continues to grow strongly, the company’s operating income increased by 17% year-on-year last year, and the growth trend logic this year remains unchanged.

2021.10.28 From the technical chart, the stock price is in an upward trend, it is recommended to hold long positions above the 20-day moving average for short-term trading, and long positions above the 60-day moving average for medium and long-term trading, the possibility of further strengthening is extremely high, and if it breaks through 320 yuan, it may challenge a new historical high. In the order of exits, short-term trading stock prices fell below the 20-day moving average and turned short, and medium and long-term trading fell below the 60-day moving average to turn short. From a fundamental point of view, the company’s new generation operating system Windows 11 is worth looking forward to, in addition, the company’s business continues to grow strongly, the company’s operating income increased by 17% year-on-year last year, and the growth trend logic this year remains unchanged.

2021.10.22 From the technical chart, the stock price is in an uptrend, it is recommended to hold long positions above the 20-day moving average for short-term trading, and long positions above the 60-day moving average for medium and long-term trading, the possibility of further strengthening is extremely high, and if it breaks through 320 yuan, it may challenge the record high. In the order of exits, short-term trading stock prices fell below the 20-day moving average and turned short, and medium and long-term trading fell below the 60-day moving average to turn short. From a fundamental point of view, the company’s new generation operating system Windows 11 is worth looking forward to, in addition, the company’s business continues to grow strongly, the company’s operating income increased by 17% year-on-year last year, and the growth trend logic this year remains unchanged.

2021.9.15 From the technical chart, the upward trend is still the same, and there is no obvious selling. If the stock price falls below the 40-day moving average, pay attention to the risk of pullback, and you can hold it for a long time before it falls below. From a fundamental point of view, the company’s new generation operating system Windows 11 is worth looking forward to, in addition, the company’s business continues to grow strongly, the company’s operating income increased by 17% year-on-year last year, and the growth trend logic this year remains unchanged.

Key Quote Data:

52 Week Range: 213.43-344.30

P/E Ratio(TTM): 25.73

EPS(TTM): $9.28

Market Cap: $17,779.61B

Numbers of employees: 221000 historical data 18100

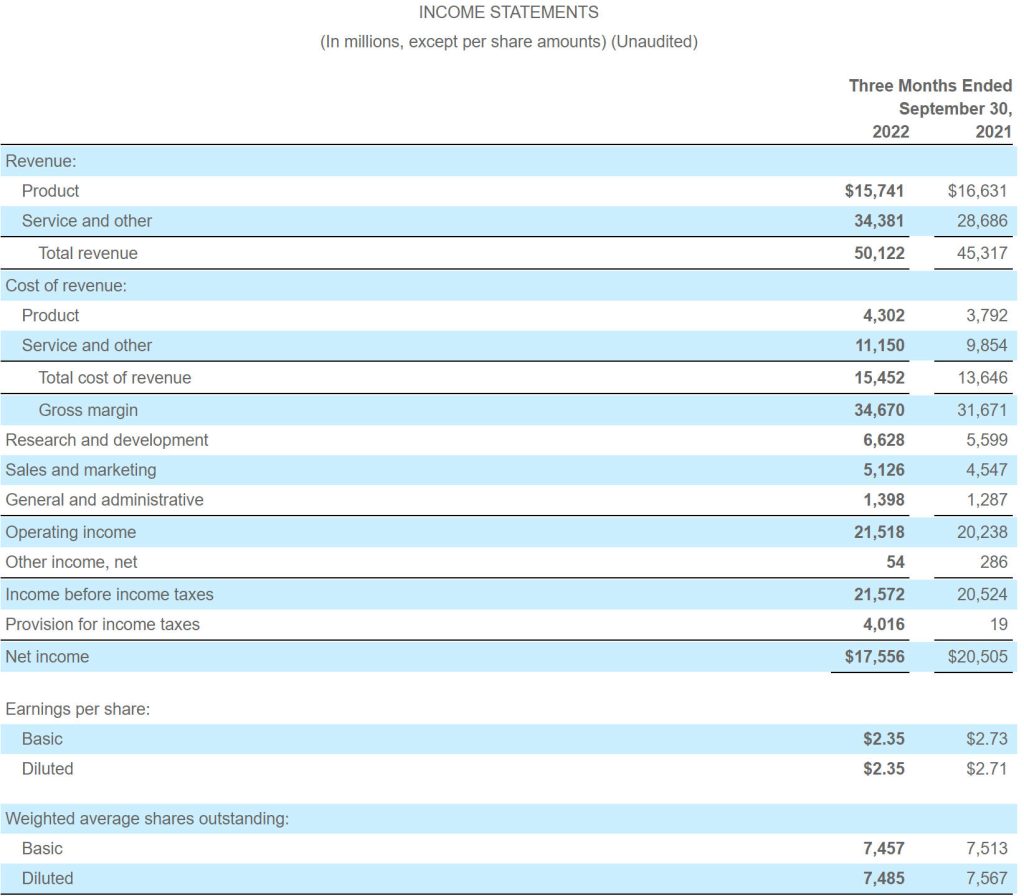

INCOME STATEMENTS

About Microsoft

Microsoft (Nasdaq “MSFT” @microsoft) enables digital transformation for the era of an intelligent cloud and an intelligent edge. Its mission is to empower every person and every organization on the planet to achieve more.