Advanced Micro Devices, Inc. (NASDAQ:AMD) Stock price trend forecast and trading range:

Updated to: 2023.2.1

(Note: The upper red line in the picture is the resistance, and the lower red line is the support)

Analysis from stock chart

—————————————————————-

Short-term trend: bullish

Sell high and buy low of range : $78 – $90

Support: $78 resistance: $90 Stop Loss Price: $78 price target: $90 Buy the position again: stop fall and rise to $78

Medium-term trend: bullish

High sell low buy range: $78 – $95

Support: $78 resistance: $95 Stop Loss price: $78 price target: $95 Buy the position again: stop fall and rise to $78

Long-term trend: bullish

High sell low buy of range: $78 – $100

Support : $78 resistance: $100 Stop Loss price: $78 price target : $100 Buy the position again: stop fall and rise to $78

From Analysis from financial statements:

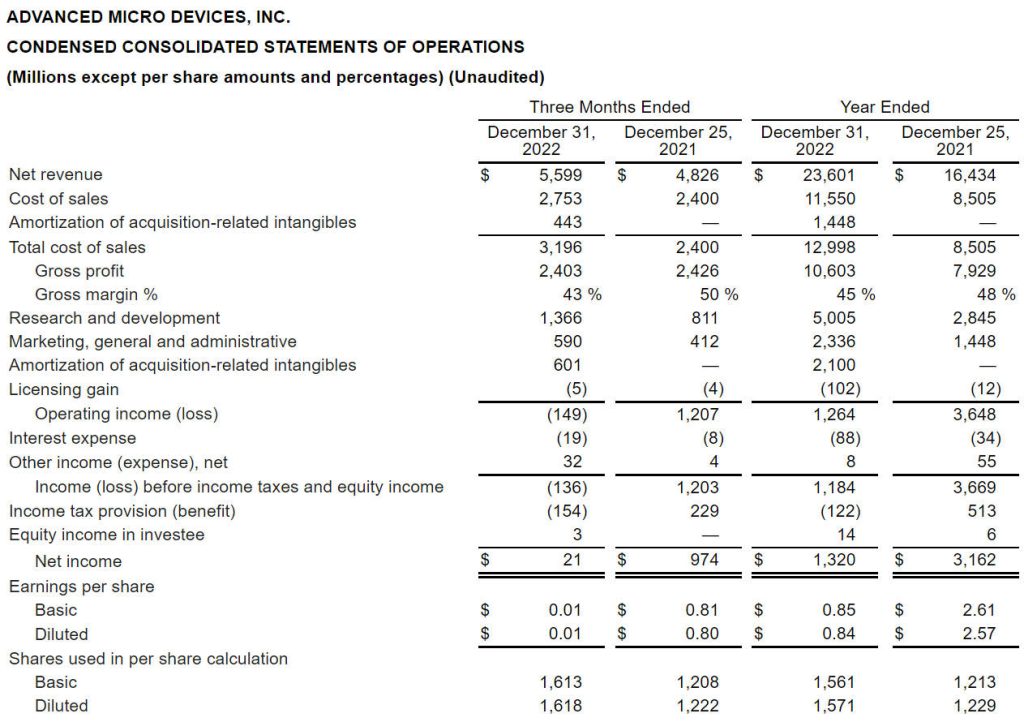

revenue for the fourth quarter of 2022 of $5.6 billion, gross margin of 43%, operating loss of $149 million, net income of $21 million and diluted earnings per share of $0.01. On a non-GAAP(*) basis, gross margin was 51%, operating income was $1.3 billion, net income was $1.1 billion and diluted earnings per share was $0.69. it is recommended to use technical graphics as a trading strategy and keep trading on the right.

Historical Forecast Record:

2022.12.29 From the stock chart analysis, the recent stock price movements have been weaker, at the 60-day moving average, but the probability of the stock price directly breaking below $54 is not high, and there may be a certain rebound range in the short term. Recommended short-term buy price above $61, stop loss price of $61, target price of $72. If the stock price falls below $61, the probability of the share price falling to $54 will rise. From the analysis of financial statements, the chip industry is headwinded, demand has fallen, and it is in a counter-cycle. Revenue for the third quarter of 2022 was $5.6 billion, gross margin was 42%, operating loss was $64 million, net income was $66 million, and diluted earnings per share were $0.04. Non-GAAP gross margin was 50%, operating income was $1.3 billion, net income was $1.1 billion and diluted earnings per share were $0.67. Fourth-quarter revenue is expected to be $5.2 billion to $5.8 billion, versus market forecast of $5.85 billion. The valuation is significantly premium to the industry average, and it is recommended to use stock chart only as a trading strategy.

Key Quote Data:

52 Week Range: 54.57-164.46

P/E Ratio(TTM): 100.76

EPS(TTM): $0.84

Market Cap: $136.47 B

Beta: 1.99

Number of employees: 15500 historical data 12600

Summary of recent financial statements

Jan. 31, 2023 AMD Reports Fourth Quarter and Full Year 2022 Financial

Results Record full year revenue of $23.6 Billion up 44% year-over-year。

today announced revenue for the fourth quarter of 2022 of $5.6 billion, gross margin of 43%, operating loss of $149 million, net income of $21 million and diluted earnings per share of $0.01. On a non-GAAP(*) basis, gross margin was 51%, operating income was $1.3 billion, net income was $1.1 billion and diluted earnings per share was $0.69.

For full year 2022, the company reported revenue of $23.6 billion, gross margin of 45%, operating income of $1.3 billion, net income of $1.3 billion and diluted earnings per share of $0.84. On a non-GAAP(*) basis, gross margin was 52%, operating income was $6.3 billion, net income was $5.5 billion and diluted earnings per share was $3.50.

Q4 2022 Results:

Revenue of $5.6 billion increased 16% year-over-year primarily driven by growth across the Embedded and Data Center segments, partially offset by lower Client and Gaming segment revenue.

Gross margin was 43%, a decrease of 7 percentage points year-over-year, primarily due to amortization of intangible assets associated with the Xilinx acquisition. Non-GAAP gross margin was 51%, an increase of 1 percentage point year-over-year, primarily driven by a richer product mix with higher Embedded and Data Center segment revenue, partially offset by lower Client segment revenue.

AMD INC.(NASDAQ:AMD) CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Q4 non-GAAP earnings of $0.69 per diluted share, Analysts polled by Capital IQ expected $0.67.

Revenue was $5.6 billion. Analysts surveyed by Capital IQ expected $5.52 billion.

The company said it expects Q1 revenue to be about $5.3 billion, plus or minus $300 million. Analysts polled by Capital IQ expect $5.51 billion.

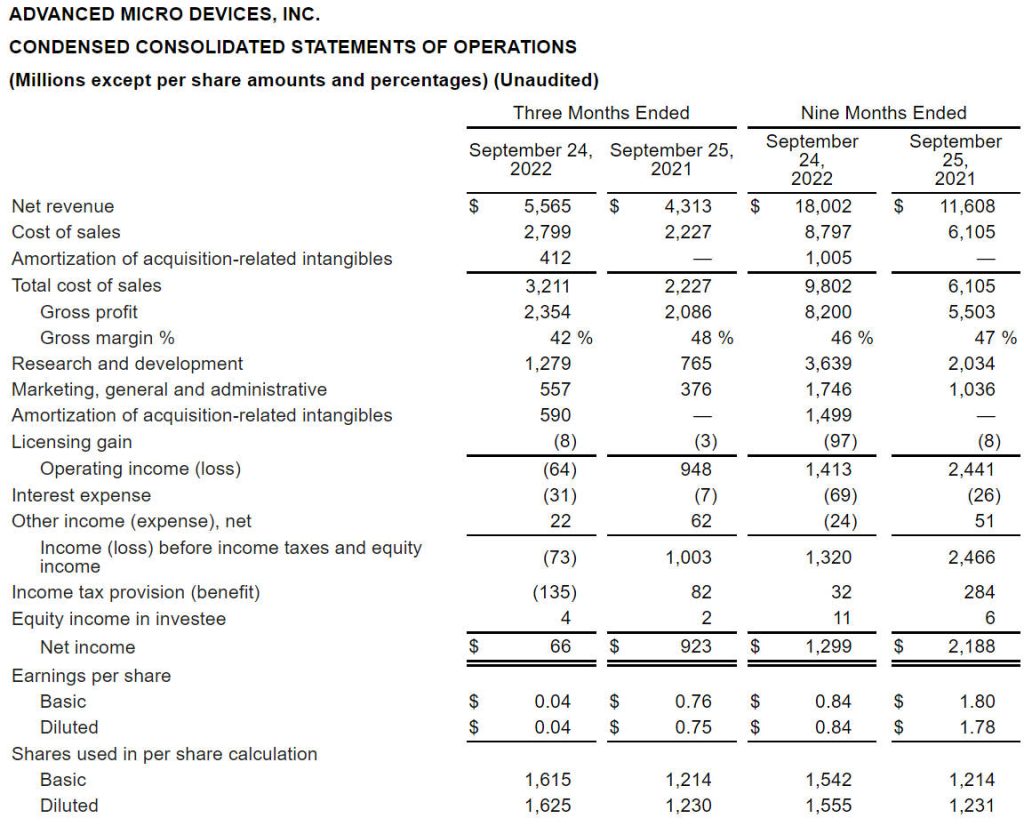

Nov. 1, 2022 revenue for the third quarter of 2022 of $5.6 billion, gross margin of 42%, operating loss of $64 million, net income of $66 million and diluted earnings per share of $0.04. On a non-GAAP basis, gross margin was 50%, operating income was $1.3 billion, net income was $1.1 billion and diluted earnings per share was $0.67.

AMD third-quarter revenue of $5.6 billion, market estimate of $5.58 billion; full-year revenue expected of $23.2 billion to $23.8 billion, market estimate of $23.89 billion; expected fourth quarter adjusted gross margin of 51%, market estimate of 52.4%; expected full-year adjusted gross margin of approximately 52%, previously expected of approximately 54%, market estimate of 52.4%; third quarter adjusted earnings per share of $0.67, market estimate of $0.65.

Q3 2022 Financial Summary

Revenue of $5.6 billion increased 29% year-over-year driven by growth across the Data Center, Gaming and Embedded segments.

Gross margin was 42%, a decrease of 6 percentage points year-over-year, primarily due to amortization of intangible assets associated with the Xilinx acquisition.

Operating loss was $64 million, compared to operating income of $948 million, or 22% of revenue, a year ago. The loss was primarily due to the amortization of intangible assets associated with the Xilinx acquisition and increased R&D investments. Non-GAAP operating income was $1.3 billion, or 23% of revenue, up from $1.1 billion or 24% a year ago primarily driven by higher revenue and gross margin partially offset by higher operating expenses.

Cash, cash equivalents and short-term investments were $5.6 billion at the end of the quarter. The company repaid the $312 million 7.50% Senior Notes that matured in August and repurchased $617 million of common stock during the quarter.

Data Center segment revenue was $1.6 billion, up 45% year-over-year driven by strong sales of EPYC™ server processors.

Client segment revenue was $1.0 billion, down 40% year-over-year due to reduced processor shipments resulting from a weak PC market and a significant inventory correction across the PC supply chain.

Gaming segment revenue was $1.6 billion, up 14% year-over-year driven by higher semi-custom product sales partially offset by lower graphics revenue. Operating income was $142 million, or 9% of revenue, compared to $231 million or 16% a year ago.

Embedded segment revenue was $1.3 billion, up 1,549% year-over-year driven primarily by the inclusion of Xilinx embedded product revenue.

Current Outlook

For the fourth quarter of 2022, AMD expects revenue to be approximately $5.5 billion, plus or minus $300 million, an increase of approximately 14% year-over-year and flat sequentially. Year-over-year and sequentially, the Embedded and Data Center segments are expected to grow. AMD expects non-GAAP gross margin to be approximately 51% in the fourth quarter of 2022.

For the full year 2022, AMD expects revenue to be approximately $23.5 billion, plus or minus $300 million, an increase of approximately 43% over 2021 led by growth in the Embedded and Data Center segments. AMD expects non-GAAP gross margin to be approximately 52% for 2022.

ADVANCED MICRO DEVICES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

About Advanced Micro Devices, Inc. (NASDAQ:AMD)

For more than 50 years AMD has driven innovation in high-performance computing, graphics and visualization technologies. AMD employees are focused on building leadership high-performance and adaptive products that push the boundaries of what is possible. Billions of people, leading Fortune 500 businesses and cutting-edge scientific research institutions around the world rely on AMD technology daily to improve how they live, work and play. For more information about how AMD is enabling today and inspiring tomorrow, visit the AMD (NASDAQ: AMD) website, blog, Facebook and Twitter pages.