Wells Fargo & Company (NYSE:WFC) Stock price trend forecast and trading range:

Updated to: January 13, 2023

(Note: The upper red line in the picture is the resistance, and the lower red line is the support)

Analysis from stock chart

—————————————————————-

Short-term trend: bullish

Sell high and buy low of range : $40 – $46

Support: $40 resistance: $46 Stop Loss Price: $43 price target: $46 Buy the position again: stop fall

Medium-term trend: neutral

High sell low buy range: $40 – $46

Support: $40 resistance: $46 Stop Loss price: $42 price target: $46 Buy the position again: stop fall

Long-term trend: neutral

High sell low buy of range: $40 – $48

Support : $40 resistance: $48 Stop Loss price: $41 price target : $48 Buy the position again: stop fall

From Analysis from financial statements:

Revenue for the fourth quarter of fiscal 2022 was $19.66 billion, market estimate of $19.95 billion, YoY-5.73%, net profit of $2.864 billion, YoY-50.19%, EPS $0.67, YoY-51.45%, market estimate of $0.66. Quarterly dividend of $0.365 per share. The business performance lacks bright spots, it is not recommended to hold in the medium and long term, and It is recommended to trade only short-term trend.

Key Quote Data:

52 Week Range: 36.05-59.18

P/E Ratio(TTM): 14.08

EPS(TTM): $3.14

Market Cap: $169.53 B

Beta: 1.17

Number of employees: 221000 historical data 18100

Summary of recent financial statements

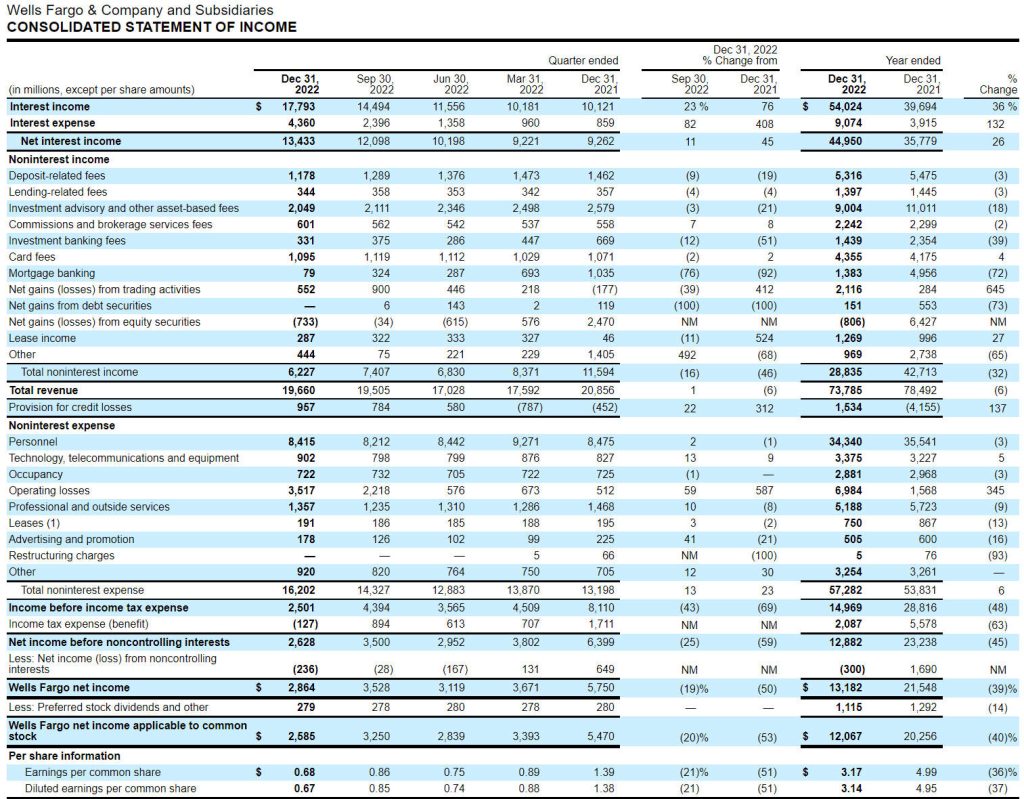

January 13, 2023 Revenue for the fourth quarter of fiscal 2022 was US$19.66 billion, market estimate was US$19.95 billion, YoY-5.73%, net profit was US$2.864 billion, YoY-50.19%, EPS was US$0.67, YoY-51.45%, and market estimate was US$0.66. Quarterly dividend of $0.365 per share. The provision for credit losses was $957 million, compared to $784 million in the previous quarter and -$452 million in the year-ago quarter. Ending loans were US$948.5 billion, up 8% year-over-year; Closing deposits were $1.38 trillion, down 6% year-on-year. Return on assets (ROA) was 0.61%, compared to 1.17% in the same period last year; Return on equity (ROE) was 6.4%, compared to 12.8% in the same period last year; Average return on tangible common stock (ROTCE) was 7.6%, compared to 15.3% in the year-ago quarter. The Tier 1 Capital Adequacy Ratio (CET1) was 10.6%, compared to 11.4% in the same period last year.

Fourth Quarter 2022 vs. Fourth Quarter 2021

Net interest income increased 45%, primarily due to the impact of higher interest rates, higher loan balances, and lower mortgage-backed securities premium amortization.

Noninterest income decreased 46%, driven by lower results in our affiliated venture capital and private equity businesses;

Noninterest expense increased 23% driven by higher operating losses primarily related to a variety of previously disclosed historical matters, including litigation, regulatory, and customer remediation matters, and higher severance expense, partially offset by lower revenue-related compensation and the impact of efficiency initiatives.

Provision for credit losses in fourth quarter 2022 included a $397 million increase in the allowance for credit losses primarily reflecting loan growth, as well as a less favorable economic environment.

Fourth Quarter 2022 vs. Third Quarter 2022

Commercial net loan charge-offs as a percentage of average loans were 0.06% (annualized), while the consumer net loan charge-off rate increased to 0.48% (annualized), up from 0.40%, primarily due to higher net loan charge-offs in the credit card portfolio.

Nonperforming assets increased 1%. Nonaccrual loans increased $39 million driven by higher commercial real estate nonaccrual loans, partially offset by lower residential mortgage nonaccrual loans.

Wells Fargo & Company and Subsidiaries CONSOLIDATED STATEMENT OF INCOME

2022.10.14 Q3 2022 revenue was US$19.51 billion, up 4% from US$18.83 billion in the same period last year, and the market expected US$18.751 billion. Net income was US$3.53 billion, compared to US$5.12 billion in the year-ago quarter, and market expectations were US$4.113 billion; Earnings per share were $0.85, compared to $1.17 in the year-ago quarter, compared to market expectations of $1.08. The provision for credit losses was $784 million.

About Wells Fargo & Company (NYSE:WFC)

Wells Fargo & Company (NYSE:WFC) is a leading financial services company that has approximately $1.9 trillion in assets, proudly serves one in three U.S. households and more than 10% of small businesses in the U.S., and is a leading middle market banking provider in the U.S. We provide a diversified set of banking, investment and mortgage products and services, as well as consumer and commercial finance, through our four reportable operating segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth & Investment Management. Wells Fargo ranked No. 41 on Fortune’s 2022 rankings of America’s largest corporations. In the communities we serve, the company focuses its social impact on building a sustainable, inclusive future for all by supporting housing affordability, small business growth, financial health and a low-carbon economy.