Micron Technology, Inc.(Nasdaq:MU) Stock price trend forecast and trading range:

Updated to: 2023.1.10

(Note: The upper red line in the picture is the resistance, and the lower red line is the support)

Analysis from stock chart

—————————————————————-

Short-term trend: bullish

Sell high and buy low of range : $54.5 – $60

Support: $48.5 resistance: $60 Stop Loss Price: $54.5 price target: $60 Buy the position again: stop fall and rise to $48.5

Medium-term trend: neutral

High sell low buy range: $54.5 – $60

Support: $48.5 resistance: $60 Stop Loss price: $54.5 price target: $60 Buy the position again: stop fall and rise to $48.5

Long-term trend: bearish

High sell low buy of range: $54.5 – $65

Support : $48.5 resistance: $65 Stop Loss price: $54.5 price target : $65 Buy the position again: stop fall and rise to $48.5

From Analysis from financial statements:

Revenue for the first quarter of fiscal 2023 was $4.085 billion, market expectations were $4.12 billion, YoY-46.86%, net income attributable to common shareholders was -$195 million, prior-$2.306 billion, and EPS was -$0.18 vs. $2.04 previously. R&D expenses were US$849 million, YoY+19.24%. Quarterly dividend of $0.115 per share. Falling into a full-blown loss in fiscal 2023 is a high-probability event, and a downward breakdown of $45 is also a high-probability event, unless the market has the capacity to exit and the fundamentals strengthen, otherwise pessimistic expectations may fall below $34. The company is a cyclical industry, the storage industry has high inventory levels, demand is obviously insufficient, and the stock price still has a long time to get out of the bull market.

Historical Forecast Record:

2022.12.23 From the stock technical graph analysis, the stock price has not fallen below the previous stage low of $48.33 even under the background of the financial report falling less than expected and the NASDAQ index plummeting, short-term buying support is strong, aggressive investors can back $48 high selling low or holding positions, stop loss price of $47, stock price stop falling and rise and close price higher than 47 yuan when the cover is made, it is not recommended for prudent investors to buy the bottom of the transaction.

2022.12.15 From the analysis of stock technical graphics, today’s stock price opened low and went low, and the intraday has fallen below my preset stop loss price of $52, and the closing price is barely above $52, which is of little practical significance. It is recommended that short-term trading be temporarily avoided, patiently wait for short-term trading opportunities after the stock price stabilizes, the stock price returns to the 60-day moving average again can chase long, it is not recommended to carry it deadly, the industry is in a downward cycle, the stock price will generally overfall, and the recovery is also very long. From a fundamental point of view, Q4 2022 achieved operating income of $6.643 billion, YoY-19.71%, net profit attributable to common shareholders of $1.492 billion, YoY-45.15%, and EPS of $1.35. Analyst expectations were $1.37 in EPS, $6.80 billion in revenue and $3.67 billion in operating cash flow. Adjusted revenue for the first quarter is expected to be $4-4.5 billion, versus analysts’ expectations of $6.02 billion. With the latest EPS annualized TTM of about 7 times, close to the bottom area of valuation, optimistic medium and long-term opportunities in the stock price of about $42, the company is a cyclical industry, the storage industry inventory level is high, demand is obviously insufficient, the stock price to get out of the bull market still has a long time.

2022.12.13 From the stock technical chart analysis, short-term stock prices temporarily at the $52.5 line of support, yesterday’s high open low indicates that buying is much weaker than the industry average, aggressive investors can back $52.5 high sell low or hold, stop loss price of $52, stock price close price back to $53 can cover positions.

2022.12.09 From the analysis of stock technical graphics, the stock price is in the grinding stage as a whole, and the rebound range is less than that of the industry, and whether 48.33 is a stage bottom remains to be confirmed. It is recommended that short-term trading and medium-term trading back to $52 high, sell low, suck or hold, stop loss price of $52, can be covered according to the situation.

2022.9.30 From the technical chart, the stock price is in a medium and long-term downtrend, there is no sign of bottoming, and aggressive investors can back to $48.45 to sell high and sell low, stopping at 48.5 yuan. For the time being, you can’t see the upside at the midline level. Recommended position 8%.

2021.12.22 From the technical chart, the stock price broke through the previous volatility range, short-term trading recommended to buy around $88, the target price is $100, and the stop loss is $85. In the medium and long term, it is recommended to hold long positions above $90, with a target of $100 and a stop loss of $85. From a fundamental point of view, storage demand is strong, and the company’s sales revenue exceeds the forecasts of the tripartite organization, with medium to long-term holding value.

2021.10.15 From the technical chart, the stock price fell below the previous low of $68, playing a new downward range. The near-term focus is on the support below $65. Leave the market for the time being, and try to avoid it before the stock price has stabilized the 20-day moving average.

2021.9.29 From the technical chart, there are signs of further weakness in the stock price, focusing on the previous low of $68 below and the important support level of $65. Leave the market for the time being, and try to avoid it before the stock price has stabilized the 60-day moving average.

2021.9.25 From the technical chart, the stock price ushered in a weak rebound near $70, short-term long orders can be around $70 fast forward and fast out, if it falls below $70, focus on the previous low of $68 below, and the important support position of $65. Long trades are only recommended above $70.

2021-08-15 From the technical chart, the stock price has broken down and fallen, long-term advice to temporarily avoid, short-term long risk is greater, pay attention to the support of the $65 line.

Key Quote Data:

52 Week Range: 48.23-95.75

P/E Ratio(TTM): 10.35

EPS(TTM): $5.51

Market Cap: $62.43 B

Beta: 1.31

Number of employees: 48000 historical data 43000

Summary of recent financial statements

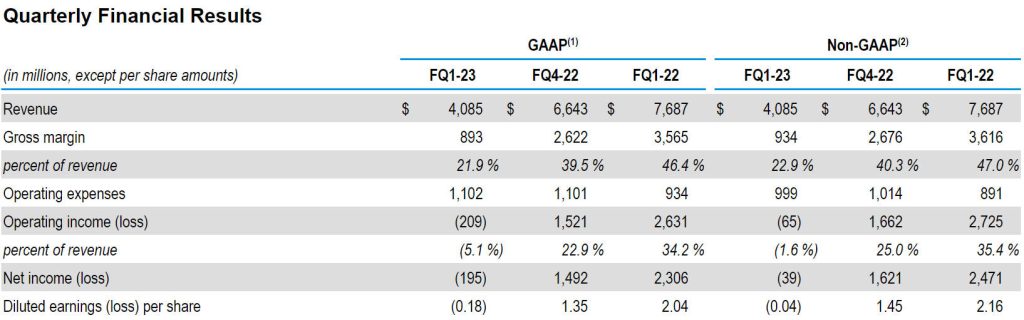

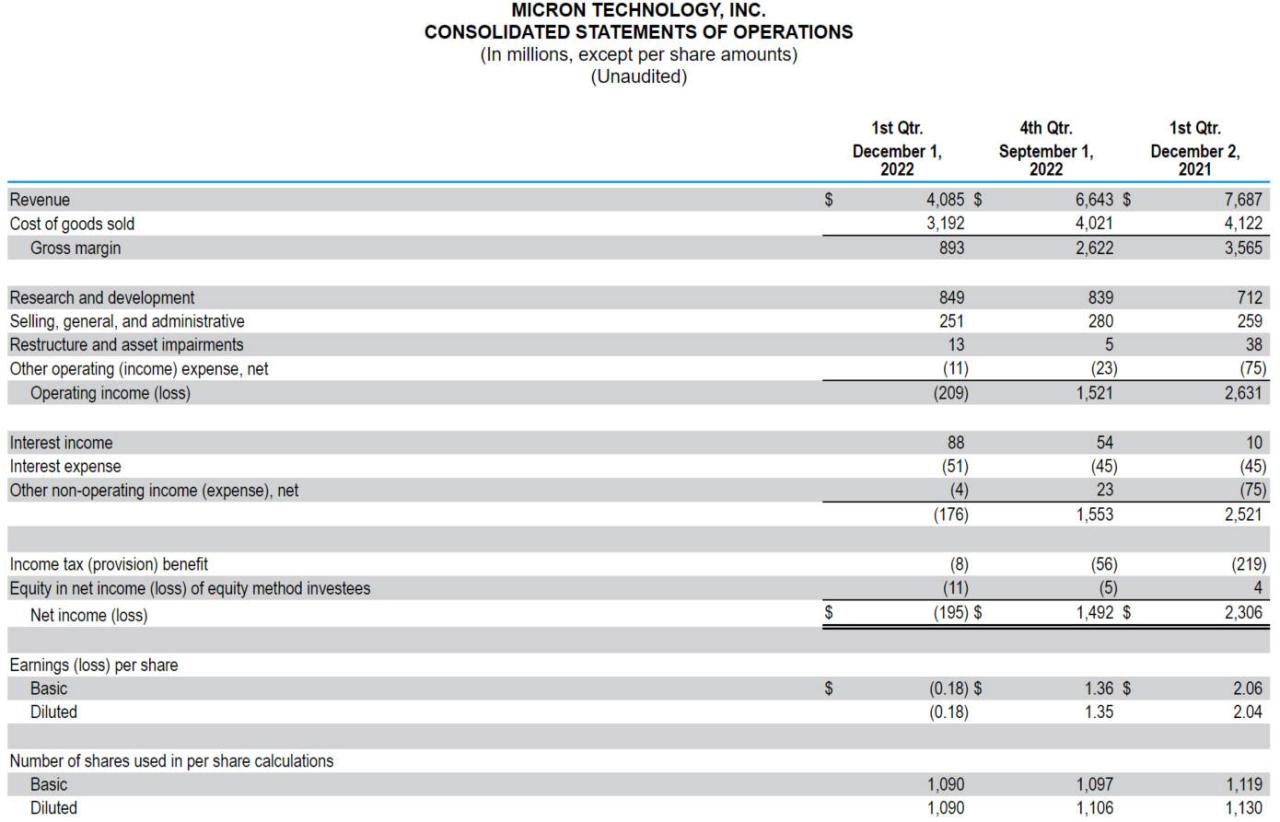

2022.12.21 Revenue for the first quarter of fiscal 2023 was US$4,085 million, market expectations were US$4.12 billion, YoY-46.86%, net income attributable to common shareholders was -US$195 million, prior-$2,306 million, EPS was -$0.18, prior-$2.04. R&D expenses were US$849 million, YoY+19.24%. Quarterly dividend of $0.115 per share. Adjusted earnings per share for the first quarter were $0.04 versus market estimates of $0.01, compared to $2.16 in the year-ago quarter. Adjusted net loss was $39 million, compared to adjusted net income of $2,471 million in the year-ago quarter. Adjusted gross margin was 22.9% versus market expectations of 24.7%. Operating cash flow was $943 million, versus market expectations of $1.83 billion. (Note: The default is GAAP, Non-GAAP will be explained separately)

Second-quarter adjusted revenue is expected to be $3.6 billion to $4.0 billion, versus market expectations of $3.88 billion. Adjusted loss per share was $0.52 to $0.72, versus a loss of $0.29. Adjusted gross margin was 6% to 11% versus market expectations of 17.8%.

On December 21, we announced a restructuring plan to address challenging industry conditions. Under the restructuring plan, we expect to reduce the number of employees by approximately 10% in calendar year 2023. Improved customer inventory is expected to increase revenue in the second half of the fiscal year. The second quarter of fiscal 2023 is expected to incur expenses of at least $30 million in connection with the restructuring plan, essentially cash expenditures.

Micron repurchased approximately 8.6 million shares of its common stock for $425 million in the first quarter of 2023 and repurchased approximately 8.6 million shares of common stock at the end of the quarter with cash, securities investments and restricted cash of $12.08 billion, resulting in a net cash(2) position of $1.81 billion. Micron Technology’s Board of Directors announced a quarterly dividend of $0.115 per share to shareholders of record as of the close of business on January 3, 2023, payable in cash on January 19, 2023.

Quarterly financial results

About Micron Technology, Inc.(Nasdaq:MU)

We are an industry leader in innovative memory and storage solutions transforming how the world uses information to enrich life for all. With a relentless focus on our customers, technology leadership, and manufacturing and operational excellence, Micron delivers a rich portfolio of high-performance DRAM, NAND, and NOR memory and storage products through our Micron® and Crucial® brands. Every day, the innovations that our people create fuel the data economy, enabling advances in artificial intelligence and 5G applications that unleash opportunities — from the data center to the intelligent edge and across the client and mobile user experience. To learn more about Micron Technology, Inc. (Nasdaq: MU), visit micron.com.