Qualcomm Inc.(NASDAQ:QCOM) Stock price trend forecast and trading range:

The mid-term low of $101.18 will not be a final bottom, and the probability of moving below is very high, focusing on the next earnings report.

Updated to: 2023.1.10

(Note: The upper red line in the picture is the resistance, and the lower red line is the support)

Analysis from stock chart

—————————————————————-

Short-term trend: bullish

Sell high and buy low of range : $112 – $122

Support: $110 resistance: $122 Stop Loss Price: $112 price target: $122 Buy the position again: stop fall and rise to $110

Medium-term trend: neutral

High sell low buy range: $110 – $122

Support: $106 resistance: $122 Stop Loss price: $110 price target: $122 Buy the position again: stop fall and rise to $106

Long-term trend: bearish

High sell low buy of range: $100 – $128

Support : $100 resistance: $128 Stop Loss price: $105 price target : $128 Buy the position again: stop fall and rise to $100

From Analysis from financial statements:

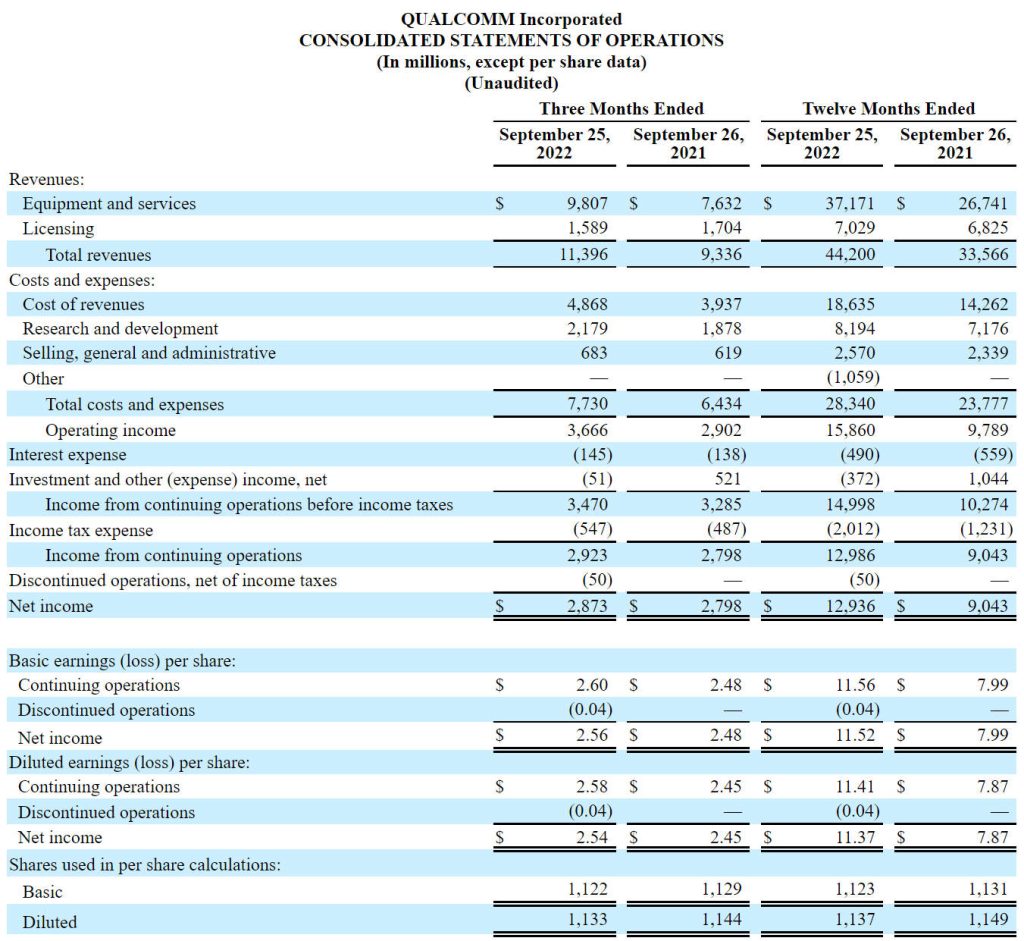

the revenue in the fourth quarter of fiscal 2022 was 11.395 billion US dollars, the market estimate was 11.37 billion US dollars, YoY + 22.05%, net profit was 2.873 billion US dollars, YoY + 2.68%, EPS 2.53 US dollars, YoY + 3.27%. R&D expenses were US$2.178 billion, YoY+15.97%. Quarterly dividend of $0.75 per share. The best medium-term and long-term bids are around $75-80. The company has lowered its Q1 2023 performance forecast, net profit has fallen by about 30%, and the current stock price does not fully reflect the downside risk of revenue.

Historical Forecast Record:

2023.1.3 From the stock price chart analysis, the semiconductor index is weaker than the NASDAQ index, and the stock price continues to fall after opening high today, although it has not fallen below the support for the time being, but it is a matter of time, the probability of the stock price falling below the support is high. Short-term trading strategies sell to reduce risk and wait for increased certainty in the stock price before trading. Medium-term and long-term trading stock prices have a higher risk of falling and are not recommended to be held at present.

Key Quote Data:

52 Week Range: 101.28-188.03

P/E Ratio(TTM): 9.4

EPS(TTM): $11.42

Market Cap: $120.17 B

Beta:1.25

Number of employees: 51000 historical data –

Summary of recent financial statements

2/11/2022 Revenue for the fourth quarter of fiscal 2022 was $11.395 billion, market estimate of $11.37 billion, YoY+22.05%, net profit of $2.873 billion, YoY+2.68%, EPS $2.53, YoY+3.27%. R&D expenses were US$2.178 billion, YoY+15.97%. Quarterly dividend of $0.75 per share.

Q1 2023 guidance: Estimated revenue of $9.2 billion to $10 billion, below market expectations of $12.02 billion, GAAP diluted earnings per share of $1.72-$1.92, non-GAAP diluted earnings per share of $2.25-$2.45, below expectations of $3.42.

Given the uncertainty caused by the macroeconomic environment, we are updating our guidance for calendar year 2022 3G/4G/5G handset volumes from a year-over-year mid-single-digit percentage decline, to a low double-digit percentage decline.

Due to these elevated levels, our largest customers are now drawing down on their inventory, negatively impacting the mid-point of our EPS guidance for the first quarter of fiscal 2023 by approximately ($0.80).

QUALCOMM Incorporated CONSOLIDATED STATEMENTS OF OPERATIONS

About Qualcomm Inc.(NASDAQ:QCOM)

Qualcomm is the world’s leading wireless technology innovator and the driving force behind the development, launch and expansion of 5G. When we connected the phone to the internet, the mobile revolution was born. Today, our foundational technologies enable the mobile ecosystem and are found in every 3G, 4G and 5G smartphone. We bring the benefits of mobile to new industries, including automotive, the internet of things and computing, and are leading the way to a world where everything and everyone can communicate and interact seamlessly.