S&P Global Inc. (NYSE:SPGI) Stock Price Trend Forecast and Market Analysis:

2022.12.30 From the stock chart analysis, the recent stock price fell 10% from the rebound high to the 60-day moving average. The probability of short-term trend continuing to maintain the 60-day moving average fluctuation is very high, and the medium-term trend is uncertain, but the long-term trend stock price upward trend is certain. Short-term trading recommends a bid price of $330, a target price of $345, a stop loss price of $325, and a short term of $330-$345 to sell high and buy low. Medium-term and long-term holding short-term profit opportunities are low, but long-term holding profit opportunities are certain. It is recommended to hold a small number of positions for a long time or sell high and buy low in the short term. From the analysis of financial statements, the third quarter of fiscal 2022 revenue was $2.861 billion, YoY+37.09%, net profit was $608 million, YoY-23.71%, EPS was $1.84, YoY-44.24%. Affected by the rising interest rate macro environment, income and net profit declined, but the competitive advantage is obvious, the long-term holding value is high, and the long-term holding logic remains unchanged.

Historical Forecast Record:

2021.10.29 From the stock graph analysis, the stock price is in an upward trend, it is recommended to hold more positions above the 20-day moving average for short-term trading, and long positions above the 60-day moving average for medium and long-term trading, the possibility of further strengthening is extremely high, and if it breaks through 480 yuan, it may challenge a new historical high. In the order of exits, short-term trading stock prices fell below the 20-day moving average and turned short, and medium and long-term trading fell below the 60-day moving average to turn short. From a fundamental point of view, the company’s revenue continues to grow, and the long-term holding value is high. The IHS Markit merger will further enhance the company’s market competitiveness. Long-term optimism.

Key Quote Data:

52 Week Range: 279.32-472.83

P/E Ratio(TTM): 28.01

EPS(TTM): $11.96

Market Cap: $109.12 B

Number of employees: 22850 historical data 23000

Summary of recent financial statements

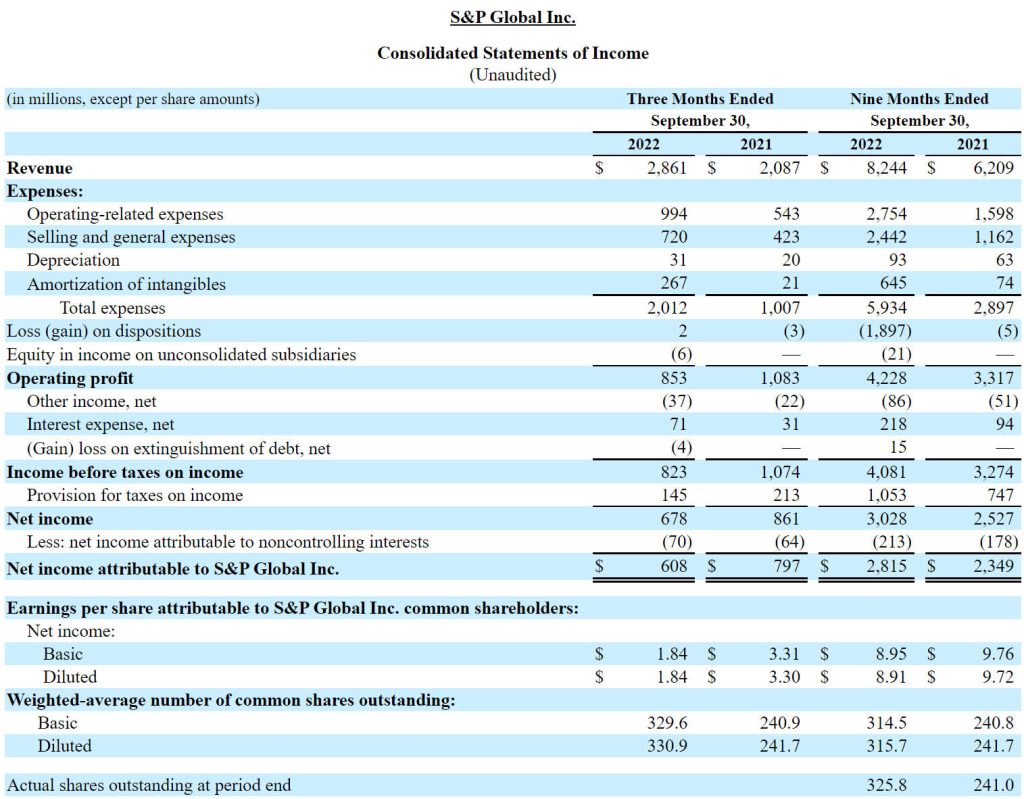

2022.10.28 Revenue for the third quarter of fiscal 2022 was $2,861 million, YoY+37.09%, net profit was $608 million, YoY-23.71%, EPS was $1.84, YoY-44.24%. Quarterly dividend of $0.85 per share. (Note: The default is GAAP, Non-GAAP will be explained separately)

Reported third quarter 2022 results with reported revenue of $2.86 billion, an increase of 37% compared to the same period last year, primarily due to the inclusion of IHS Markit businesses, partially offset by declines in Ratings revenue. Continued execution drove growth across most of the Company’s six divisions, while Ratings transaction revenue continues to be negatively impacted by a sharp year-over-year reduction in debt issuance. GAAP net income decreased 24% to $608 million and GAAP diluted earnings per share decreased 44% to $1.84 primarily due to the increase in shares outstanding as a result of the merger with IHS Markit.

Profit Margin: The Company’s reported operating profit margin decreased 2,210 basis points to 29.8% due to the inclusion of IHS Markit and costs associated with the merger.

Return of Capital: In 2022, through the third quarter, the Company returned more than $11.7 billion to shareholders through a combination of $11 billion in the form of an accelerated share repurchase (ASR) agreement and $749 million in cash dividends. Year-to-date, the Company has completed 92% of its previously announced $12 billion ASR program, which the Company still expects to be completed by the end of the year. The remaining $1 billion of the ASR is expected to launch in December.

Market Intelligence: Reported revenue increased 83% to $1.02 billion in the third quarter of 2022 driven primarily by the inclusion of IHS Markit revenue and increased 1% compared to pro forma revenue.

Ratings: Reported revenue decreased 33% to $681 million in the third quarter of 2022. Transaction revenue decreased 56% to $244 million.

Commodity Insights: Reported revenue increased 70% to $432 million compared to the third quarter of 2022, primarily driven by the inclusion of IHS Markit, and increased 5% compared to pro forma revenue driven by Price Assessments, and strong growth in Energy & Resources Data & Insights, offset by slight declines in Upstream Data & Insights and Advisory & Transaction Services.

Outlook: 2022 reported revenue is expected to increase more than 30%. GAAP diluted EPS is expected to be in a range of $9.75 to $9.90.

S&P Global Inc. Consolidated Statements of Income

About S&P Global Inc. (NYSE:SPGI)

S&P Global (NYSE: SPGI) provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world.