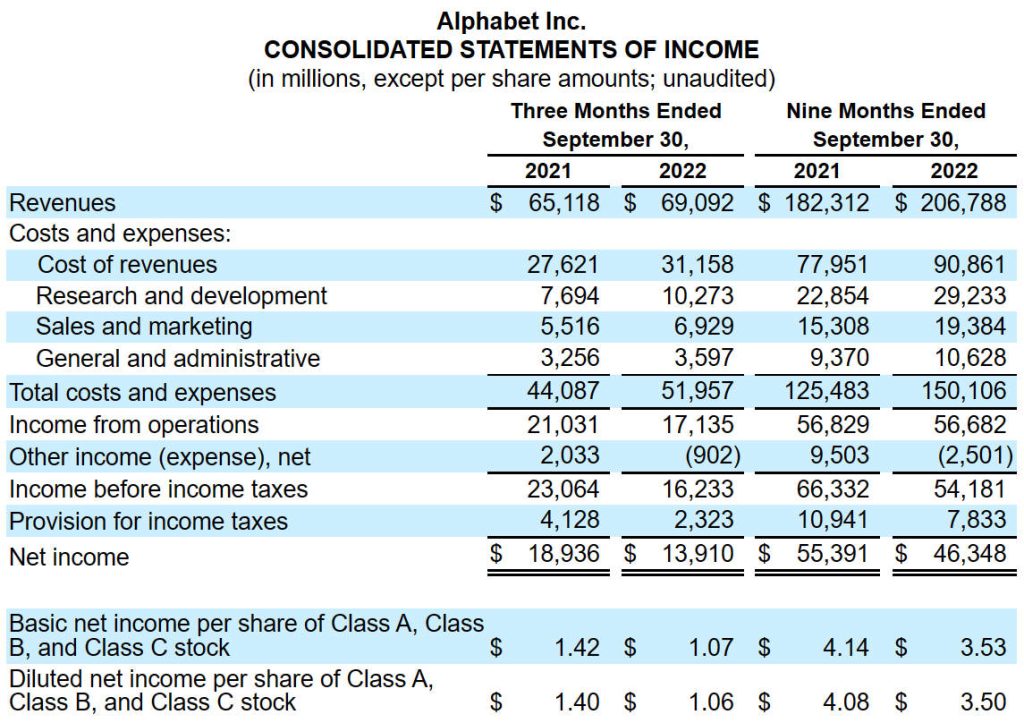

Alphabet Inc. (NASDAQ:GOOGL) stock price trend forecast and market analysis: 2022.12.30 From the stock chart analysis, the recent stock price followed the NASDAQ index synchronous decline, the stock price fell again to the previous low point around $83.34, the short-term stock price trend mainly follows the index, short-term trading buy price of $86, target price of $89, stop loss price of $85, can repeatedly buy low and sell high. The medium-term bid price is $86, the target price is $100, and the stop loss price is $84. Long-term holdings are very uncertain about short-term returns. From Analysis from financial statements, the revenue in the third quarter of fiscal 2022 was US$69.092 billion, the market estimates US$70.76 billion, YoY + 6.10%, net profit attributable to common shareholders was US$13.91 billion, YoY-26.54%, EPS was US$1.06, YoY-24.26%. Overall revenue continued to grow, but Q4 faced great challenges, and net profit may decline further. At present, the stock price has obvious long-term holding value advantages, but the short-term profit opportunities are low.

Historical Forecast Record:

2021.10.28 From the technical chart, the stock price is in an uptrend, it is recommended to hold long positions above the 20-day moving average for short-term trading, and long positions above the 60-day moving average for medium and long-term trading, which is highly likely to strengthen further. In the order of exits, short-term trading stock prices fell below the 20-day moving average and turned short, and medium and long-term trading fell below the 60-day moving average to turn short. From a fundamental point of view, although the stock price is more expensive, it has maintained rapid growth, and it is recommended to hold it for a long time and ignore short-term fluctuations.

2021.9.18 From the technical chart, the rally does not stop, and it can be held for a long time before the stock price falls below the 60-day moving average.

Key Quote Data:

52 Week Range: 83.34-151.55

P/E Ratio(TTM): 17.75

EPS(TTM): $4.97

Market Cap: $1,145.00 B

Number of employees: 156500 historical data 150028

Summary of recent financial statements

26/10/2022 Revenue for the third quarter of fiscal 2022 was $69.092 billion, market estimates were $70.76 billion, YoY +6.10%, net income attributable to common shareholders was $13.91 billion, YoY-26.54%, EPS $1.06, YoY-24.26%. R&D expenses were 10.273 billion US dollars, YoY+33.52%. (Note: The default is GAAP, Non-GAAP will be explained separately)

Alphabet’s third-quarter revenue was $69.09 billion, lower than the expected $70.76 billion; of which search business revenue was $39.539 billion, lower than the expected $40.863 billion; youtube business revenue unexpectedly fell 1.85%, and the market expected an increase of 5.47%; Advertising revenue of US$54.48 billion, lower than the expected US$56.98 billion, and the growth rate fell to 2.54% from 43% in the same period last year, far lower than the market expectation of 7.2%. Cloud revenue of $6.86 billion exceeded expectations of $6.61 billion, adjusted earnings per share of $1.06, below expectations of $125 million, and free cash flow of $16.07 billion, below expectations of $20.27 billion. Google expects the negative impact on foreign exchange in the fourth quarter to be even greater, with the number of new employees added in the fourth quarter being less than half of the third quarter; The macro environment ahead is challenging, and the hiring slowdown will be more pronounced in 2023.

Alphabet Inc. CONSOLIDATED STATEMENTS OF INCOME

About Alphabet Inc. (NASDAQ:GOOGL)

Alphabet, Inc. is a holding company, which engages in the business of acquisition and operation of different companies. It operates through the Google and Other Bets segments. The Google segment includes its main Internet products such as ads, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search, and YouTube. The Other Bets segment consists of businesses such as Access, Calico, CapitalG, GV, Verily, Waymo, and X. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.