Target (NYSE:TGT) stock price trend forecast and market analysis:

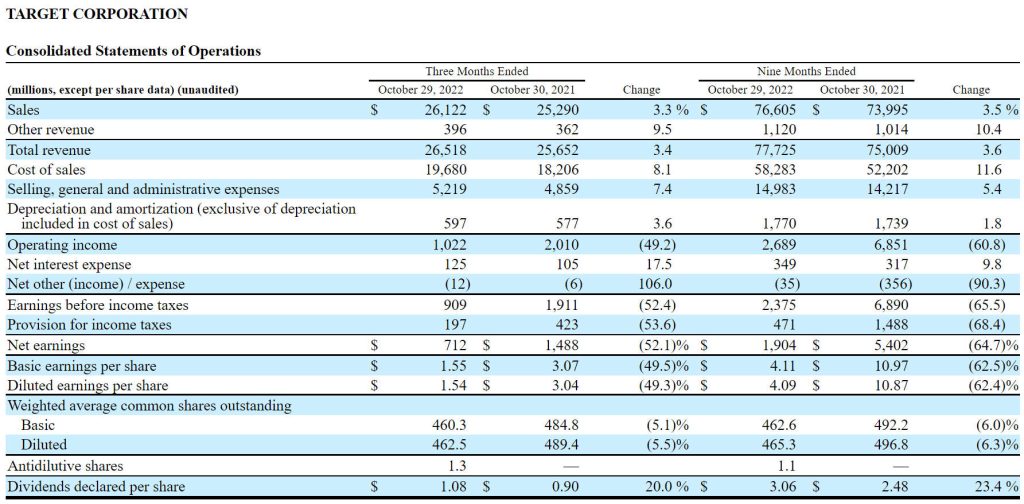

2022.12.30 From the stock chart analysis, the recent stock price has rebounded slightly after falling below $140, and the probability of the stock price falling is high, and the short-term buy price is recommended above $140, the price target is $148, and the stop loss price is $140. Medium-term and long-term holding margins are not visible for the time being. The medium-term stock price trend falling to $130 is a high probability event, and the current stock price trend only suggests a short-term rebound. From Analysis from financial statements, Q3 2022 achieved revenue of $26.12 billion, market estimate of $25.97 billion, YoY+3.3%, net profit attributable to common shareholders of $712 million, YoY-52.1%, EPS of $1.54, and expectation of $2.15. Quarterly dividend of $1.08 per share. The basic performance judgment shows that the medium-term and long-term trading range is between $120 and $220, and there is a long-term holding value space below $130. In the past three years, the company’s revenue has grown steadily at an average rate of more than 10%, with obvious competitive advantages and can be held for a long time.

Historical Forecast Record:

2022.11.16 From the technical chart, affected by the financial report less than expected, it fell 14% pre-market, and it is recommended that medium-term and short-term trading back to $145 to sell high or sell low or hold, stop loss $145. A break below $145 could open new downside.

Key Quote Data:

52 Week Range: 137.16-254.87

P/E Ratio(TTM): 20.41

EPS(TTM): $7.30

Market Cap: $68.60 B

Number of employees: 450000 historical data

Summary of recent financial statements

2022.11.16 Q3 2022 revenue was US$26.12 billion, market estimate of US$25.97 billion, YoY+3.3%, net income attributable to common shareholders of US$712 million, YoY-52.1%, EPS US$1.54, market estimate of US$2.15. Quarterly dividend of $1.08 per share.

Operating Results

Category performance was led by growth in frequency businesses including Beauty, Food and Beverage and Household Essentials, which offset continued softness in discretionary categories.

The Company announced an enterprise initiative to simplify and gain efficiencies across its business, representing an estimated cumulative savings opportunity of $2 to $3 billion over the next three years.

In light of an increasingly challenging environment, the Company lowered its topline and bottom line expectations for the fourth quarter.

Comparable sales grew 2.7 percent in the third quarter, reflecting comparable store sales growth of 3.2 percent and comparable digital sales growth of 0.3 percent. Total revenue of $26.5 billion grew 3.4 percent compared with last year, reflecting total sales growth of 3.3 percent and a 9.5 percent increase in other revenue. Operating income was $1.0 billion in third quarter 2022, down 49.2 percent from $2.0 billion in 2021, driven primarily by a decline in the Company’s gross margin rate.

Third quarter operating income margin rate was 3.9 percent in 2022, compared with 7.8 percent in 2021. Third quarter gross margin rate was 24.7 percent, compared with 28.0 percent in 2021. This year’s gross margin rate reflected higher markdown rates, inventory shrink, and merchandise and freight costs, net of retail price increases, compared with last year. Additionally, gross margin rate was pressured by increased compensation and headcount in our distribution centers and the costs of managing early receipts of inventory, with a slight offset from favorable category mix. Third quarter SG&A expense rate was 19.7 percent in 2022, compared with 18.9 percent in 2021. This reflected the impact of cost inflation across multiple parts of the business, including investments in hourly team member compensation, which was partially offset by lower incentive compensation.

The Company did not repurchase stock in the third quarter. As of the end of the third quarter, the Company had approximately $9.7 billion of remaining capacity under the repurchase program approved by Target’s Board of Directors in August 2021.

Fiscal 2022 Guidance

Based on softening sales and profit trends that emerged late in the third quarter and persisted into November, the Company believes it is prudent to plan for a wide range of sales outcomes in the fourth quarter, centered around a low-single digit decline in comparable sales, consistent with those recent trends. Similarly, the Company is now planning a wide range for its fourth quarter operating margin rate centered around 3 percent.

TARGET CORPORATION Consolidated Statements of Operations

About Target Corp. (NYSE:TGT)

Minneapolis-based Target Corporation (NYSE: TGT) serves guests at nearly 2,000 stores and at Target.com, with the purpose of helping all families discover the joy of everyday life. Since 1946, Target has given 5% of its profit to communities, which today equals millions of dollars a week. For the latest store count or more information, visit Target.com/Pressroom. For a behind-the-scenes look at Target, visit Target.com/abullseyeview or follow @TargetNews on Twitter.