March 7, 2023 — CrowdStrike Holdings, Inc. (Nasdaq: CRWD), a global cybersecurity leader that provides cloud-delivered protection of endpoints, cloud workloads, identity and data, today announced financial results for the fourth quarter and fiscal year 2023, ended January 31, 2023.

CrowdStrike(NASDAQ:CRWD) reported fiscal Q4 non-GAAP earnings of $0.47 per diluted share,

Analysts polled by Capital IQ estimated $0.43.

Revenue for the quarter ended Jan. 31 was $637.4 million,

Analysts surveyed by Capital IQ forecast $626.8 million.

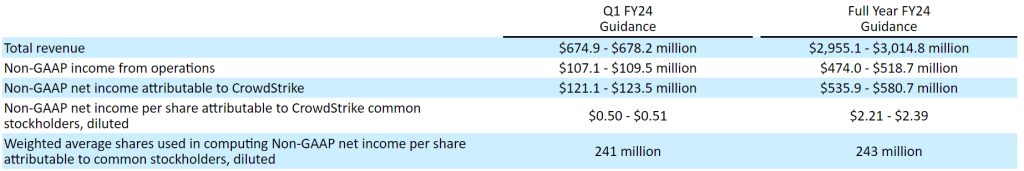

The cloud-based security company said it projects fiscal Q1 non-GAAP EPS of $0.50 to $0.51 on revenue of $674.9 million to $678.2 million. Analysts polled by Capital IQ are looking for $0.43 and $666.3 million, respectively.

The company also said it projects fiscal 2024 non-GAAP EPS between $2.21 and $2.39 and revenue between $2.96 billion and $3.01 billion. Analysts surveyed by Capital IQ are expecting $2.02 and $2.97 billion.

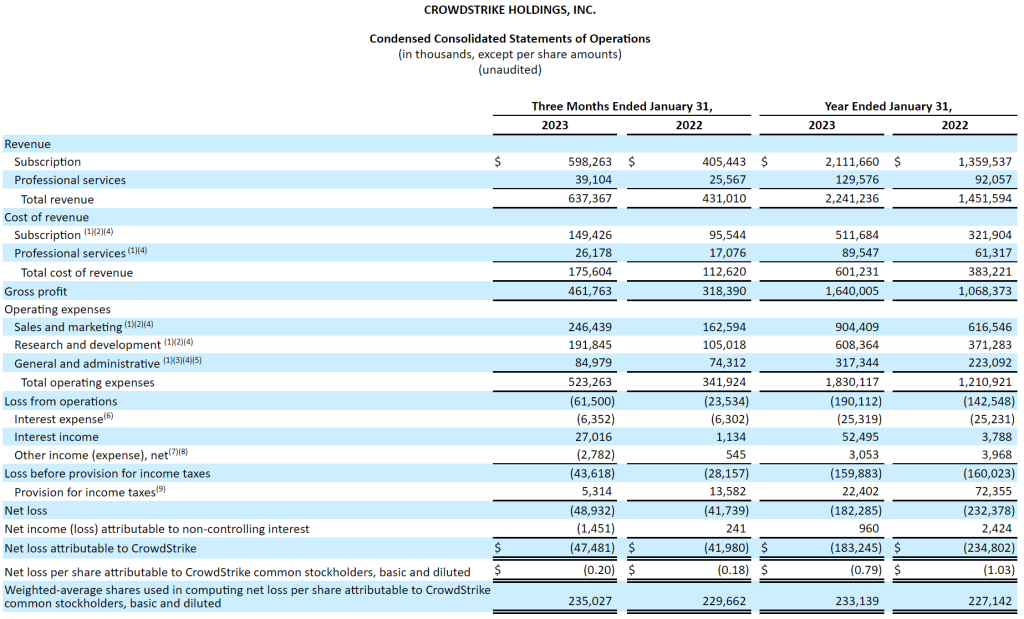

Fourth Quarter Fiscal 2023 Financial

Revenue: Total revenue was $637.4 million, a 48% increase, compared to $431.0 million in the fourth quarter of fiscal 2022. Subscription revenue was $598.3 million, a 48% increase, compared to $405.4 million in the fourth quarter of fiscal 2022.

Annual Recurring Revenue (ARR) increased 48% year-over-year and grew to $2.56 billion as of January 31, 2023, of which $221.7 million was net new ARR added in the quarter.

Cash Flow: Net cash generated from operations was $273.3 million, compared to $159.7 million in the fourth quarter of fiscal 2022. Free cash flow was $209.5 million, compared to $127.3 million in the fourth quarter of fiscal 2022.

Added 1,873 net new subscription customers in the quarter for a total of 23,019 subscription customers as of January 31, 2023, representing 41% growth year-over-year.

Full Year Fiscal 2023 Financial

Revenue: Total revenue was $2.24 billion, a 54% increase, compared to $1.45 billion in fiscal 2022. Subscription revenue was $2.11 billion, a 55% increase, compared to $1.36 billion in fiscal 2022.

Subscription Gross Margin: GAAP subscription gross margin was 76% in both fiscal 2023 and 2022. Non-GAAP subscription gross margin was 78%, compared to 79% in fiscal 2022.

Cash Flow: Net cash generated from operations was $941.0 million, compared to $574.8 million in fiscal 2022. Free cash flow was $676.8 million, compared to $441.8 million in fiscal 2022.

Financial Outlook

CROWDSTRIKE HOLDINGS, INC. Condensed Consolidated Statements of Operations

About CrowdStrike Holdings

CrowdStrike Holdings, Inc. is a global cybersecurity leader that provides cloud-delivered protection of endpoints, cloud workloads, identity and data.

Powered by the CrowdStrike Security Cloud and advanced artificial intelligence, the CrowdStrike Falcon® platform delivers better outcomes to customers through rapid and scalable deployment, superior protection and performance, reduced complexity and immediate time-to-value.

CrowdStrike Falcon leverages a single lightweight-agent architecture with integrated cloud modules spanning multiple security markets, including corporate workload security, managed security services, security and vulnerability management, IT operations management, threat intelligence services, identity protection and log management.