January 25, 2023 – Nasdaq, Inc. (Nasdaq: NDAQ) today reported financial results for the fourth quarter and year 2022.

Nasdaq, Inc.(NASDAQ:NDAQ) reported Q4 adjusted earnings Wednesday of $0.64 per diluted share, Analysts polled by Capital IQ forecast adjusted earnings of $0.65 per share.

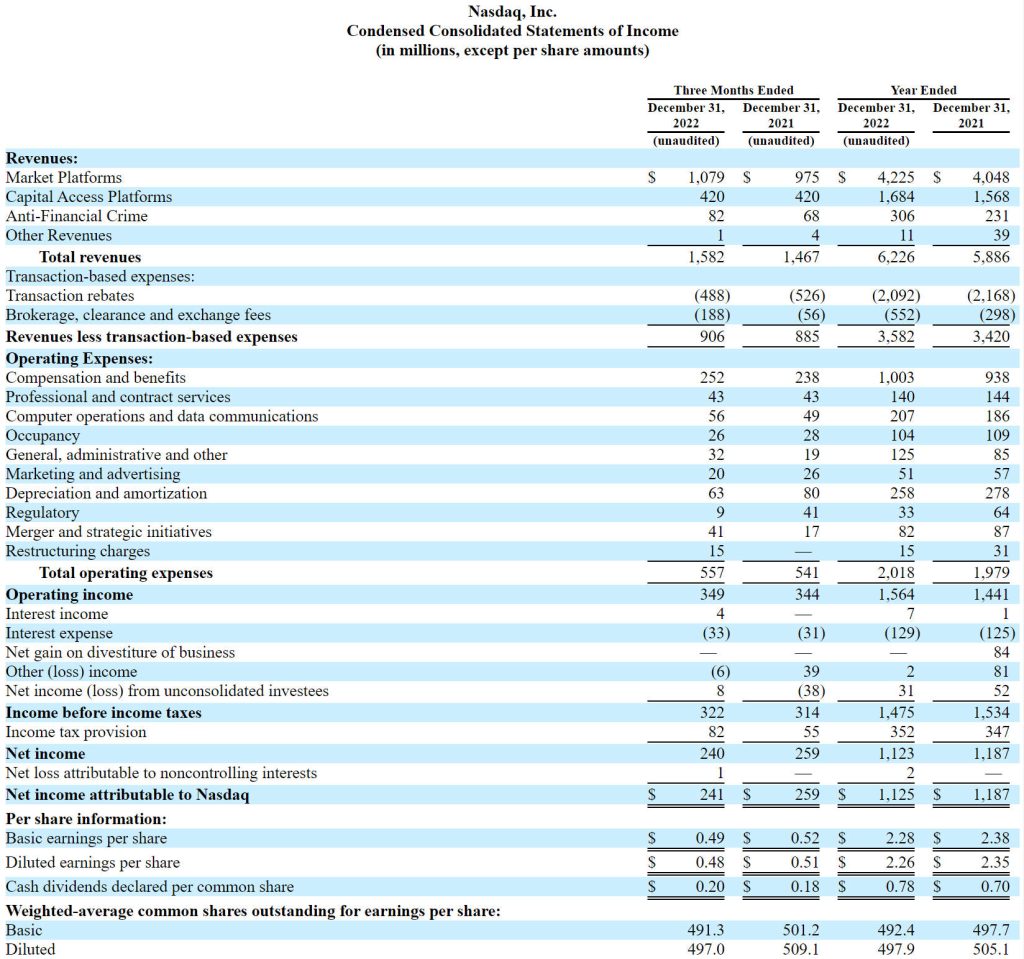

Nasdaq, Inc.(NASDAQ:NDAQ) Net revenue was $906 million, The consensus estimate of analysts polled by Capital IQ was for revenue of $908.9 million.

The Board of Directors of Nasdaq, Inc.has declared a regular quarterly dividend of $0.20 per share on the company’s outstanding common stock.

Q4 2022 result

2022 net revenues were $3,582 million, an increase of $162 million, or 5% over 2021.

Fourth quarter 2022 net revenues were $906 million, an increase of $21 million, or 2%, from $885 million in the prior year period.

Solutions businesses revenues were $652 million in the fourth quarter of 2022, an increase of $21 million, or 3%.

Trading Services net revenues were $253 million in the fourth quarter of 2022, an increase of $3 million, or 1%.

The company returned $1,016 million to shareholders in 2022: $633 million in share repurchases and $383 million in dividends.

The company is initiating its 2023 non-GAAP operating expense guidance to a range of $1,770 to $1,850 million. Nasdaq expects its 2023 non-GAAP tax rate to be in the range of 24% to 26%.

STRATEGIC AND BUSINESS UPDATES

Nasdaq implemented its new corporate structure during the fourth quarter of 2022 to amplify strategy. Nasdaq’s new corporate structure took effect during the fourth quarter of 2022 with business units organized into three divisions: Market Platforms, Capital Access Platforms, and Anti-Financial Crime. The new structure aligns the company more closely with evolving client needs and global financial system.

Nasdaq’s annualized SaaS revenues in the fourth quarter of 2022 increased 13% year over year. Annualized SaaS revenues totaled $725 million in the fourth quarter of 2022, representing 36% of total company ARR, up from 34% in the fourth quarter of 2021. The 13% year over year increase in annualized SaaS revenues primarily reflects strong growth in the fraud detection and anti-money laundering solutions and Workflow and Insights businesses.

Nasdaq, Inc. Condensed Consolidated Statements of Income

ABOUT NASDAQ

Nasdaq (Nasdaq: NDAQ) is a global technology company serving the capital markets and other industries. Our diverse offering of data, analytics, software and services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions and career opportunities, visit us on LinkedIn, on Twitter @Nasdaq, or at www.nasdaq.com.

Nasdaq maintained listings leadership in the U.S. and Nordics during 2022. The Nasdaq Stock Market led U.S. exchanges for operating company IPOs with a 92% total win rate during 2022 and 100% win rate in the fourth quarter of 2022. During 2022, the Nasdaq Stock Market featured six of the largest ten U.S. IPOs by capital raised, attracted 74% of all proceeds raised through U.S. IPOs and welcomed 14 listing switches. In the Nordic and Baltic regions, Nasdaq maintained its leadership positioning with 38 IPOs.