NEW YORK, NY – February 13, 2024 – Moody’s Corporation (NYSE: MCO) today announced results for the fourth quarter and full year 2023, and provided its outlook for full year 2024.

REVENUE

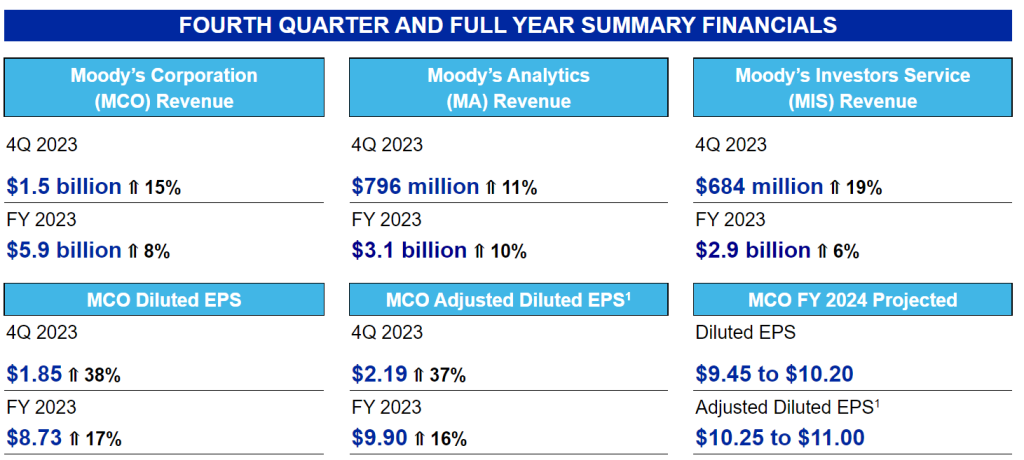

Fourth Quarter 2023

•Revenue increased 15%, or 13% on a constant currency basis1, from the prior-year period.

•MA’s revenue grew 11%, or 10% on a constant currency basis1, from the prior-year period, with all lines of business achieving double-digit revenue growth.

•MIS’s revenue grew 19%, or 17% on a constant currency basis1, from the prior-year period, as debt capital markets continued to recover and the outlook for macroeconomic conditions improved.

Full Year 2023

•Revenue increased to $5.9 billion, up 8% from the prior year.

•MA’s revenue grew 10% from the prior year, to over $3 billion, now representing 52% of MCO’s total revenue.

•MIS’s revenue grew 6% as markets stabilized and issuers acclimatized to the higher interest rate environment.

•Foreign currency exchange had an immaterial impact on MCO, MA and MIS’s revenues.

CAPITAL ALLOCATION AND LIQUIDITY

•Cash flow from operations was $2,151 million and free cash flow1 was $1,880 million.

•The increase in free cash flow1 is due to improvements in working capital and higher net income, mainly driven by robust revenue growth from both segments.

•On February 5, 2024, the Board of Directors declared a regular quarterly dividend of $0.85 per share of MCO Common Stock, a 10% increase from the prior quarterly dividend of $0.77 per share. The dividend will be payable on March 15, 2024, to stockholders of record at the close of business on February 23, 2024.

•During the fourth quarter of 2023, Moody’s repurchased 0.6 million shares at an average cost of $346.80 per share and issued net 0.1 million shares as part of its employee stock-based compensation programs. The net amount included shares withheld for employee payroll taxes.

•As of December 31, 2023, Moody’s had 182 million shares outstanding, with approximately $359 million of share repurchase authority remaining. On February 5, 2024, the Board of Directors authorized an additional $1 billion in share repurchase authority.

•As of December 31, 2023, Moody’s had $7.0 billion of outstanding debt and an undrawn $1.25 billion revolving credit facility.

•The increase in free cash flow1 is due to improvements in working capital and higher net income, mainly driven by robust revenue growth from both segments.

•On February 5, 2024, the Board of Directors declared a regular quarterly dividend of $0.85 per share of MCO Common Stock, a 10% increase from the prior quarterly dividend of $0.77 per share. The dividend will be payable on March 15, 2024, to stockholders of record at the close of business on February 23, 2024.

•During the fourth quarter of 2023, Moody’s repurchased 0.6 million shares at an average cost of $346.80 per share and issued net 0.1 million shares as part of its employee stock-based compensation programs. The net amount included shares withheld for employee payroll taxes.

•As of December 31, 2023, Moody’s had 182 million shares outstanding, with approximately $359 million of share repurchase authority remaining. On February 5, 2024, the Board of Directors authorized an additional $1 billion in share repurchase authority.

•As of December 31, 2023, Moody’s had $7.0 billion of outstanding debt and an undrawn $1.25 billion revolving credit facility.